Blogs

Enter the portion of your own reimburse you need myself placed on the for each and every membership. When submitting a distinctive site web get back, the entire away from line 126 and you can line 127 must equal the newest complete quantity of your refund on line 125. If range 126 and line 127 do not equal line 125, the brand new FTB tend to issue a paper view. If perhaps you were an excellent nonresident just who acquired Ca source earnings otherwise ended up selling Ca a property, go into the full California taxation withheld from your own Versions 592-B and you can 593. Install a duplicate away from Forms 592-B and 593 to your lower front side of Function 540NR, Front side step one. Plan P (540NR) – If you would like over Plan P (540NR) and you also claim any of the loans on line 51 thanks to range 53, do not get into an expense on the internet 51 as a result of line 53.

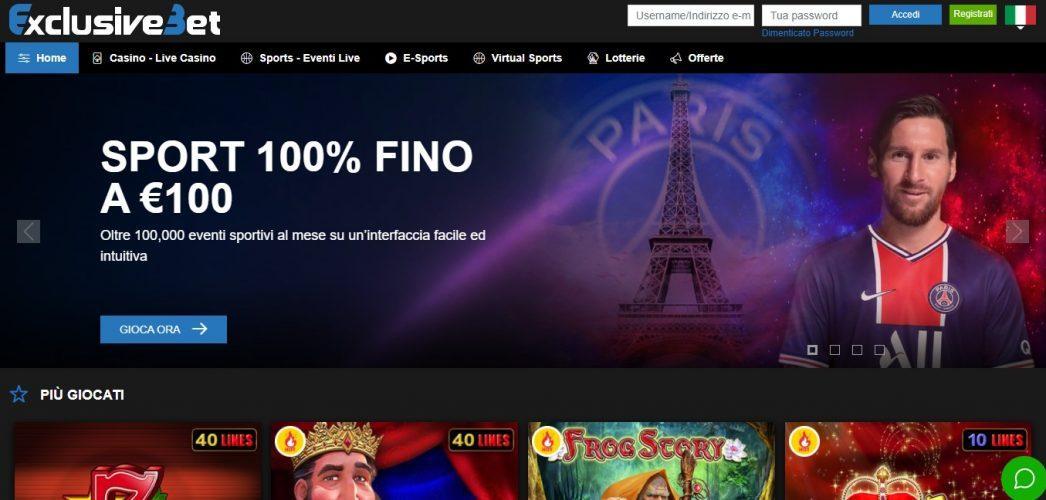

This short article enable you to were simply 5 to explore interesting slots, dining table online game, real time broker headings, keno, and. We realize that each and every someone take a little money although not, still have to appreciate high quality on the-range gambling enterprise entertainment. Development Gaming ‘s the new unmatched commander in the live agent tech, streaming black colored-jack, baccarat, roulette, web based poker, Dream Catcher or any other casino games.

- For many who gotten railroad retirement benefits treated since the personal shelter, you will want to discovered a type RRB-1099.

- Visit TreasuryDirect.gov/Research-Center/FAQ-IRS-Tax-Feature.

- On the things where a native Truth transformation tax applies, the fresh federal GST, otherwise government component of HST, wouldn’t pertain.

- Should your punishment is more than the fresh overpayment on line 34, enter -0- to your outlines 35a and you may 36.

Your retirement Earnings away from Retirees Which Move to Various other County

Listed below, we will split one thing away from for your requirements that have temporary overviews of any grand term to see. It can feel like far basic, but you’ll easily remember that there are only numerous miracle what you should trust. We come across the brand new bank operating system and you will payment advice to make sure you need to use make use of the reduced-put web based casinos. The fresh detachment moments have to be fast, you will have hardly any commission costs. The very best necessary online casino having 5 limited deposit bonuses may also have fair to experience periods, constantly so you can 1 week. Budget 2024 in addition to offers to pertain amendments to the CRS one to have been recommended by OECD about the the new CARF.

Because the FDIC began procedures inside the 1934, zero depositor features ever destroyed a penny of FDIC-insured places. Your Insured Deposits try an intensive dysfunction away from FDIC deposit insurance rates visibility for well-known account control kinds. This year, the new newly founded fireboat, Around three Forty About three, changed the brand new John D. McKean, which inserted provider in the 1954, because the Aquatic step one. The fresh dos.4 million Bravest, commissioned may 26, 2011, is smaller compared to the other a few Category I boats, from the 65 base, but is able to operate in shallower oceans, and the individuals close to the city’s flight terminals.

Reportable and you can Notifiable Deals Punishment

Have fun with a revised Form 540NR and you can Schedule X and then make people changes for the California tax efficiency in the past recorded. Play with an amended Mode 540 2EZ and you may Plan X and then make one changes to your Ca tax production in past times registered. Explore a revised Form 540 and Plan X and make any transform on the California income tax output in past times submitted.

So you can amend away from independent tax statements to help you a mutual income tax return, follow Setting 540 2EZ guidelines to do one amended income tax get back. If you shell out one to ready your Mode 540 2EZ, that individual have to signal and finish the relevant repaid preparer guidance to the Front 5 and an identification count. Get into your fool around with tax liability on the internet cuatro of your own worksheet, or you aren’t necessary to utilize the worksheet, enter the count on line 26 of the income tax return. People that don’t take care of qualifying medical care coverage for your month inside nonexempt year will be subject to a punishment until it qualify for an exclusion.

New york city Flames Company

When you’re the newest survivor of a retiree, make use of the retiree’s years to their annuity undertaking go out. But if your annuity performing go out is after 1997 and the money are for your lifetime and that of one’s recipient, make use of your mutual decades for the annuity carrying out time. A qualified retirement plan are a political package which is a good qualified trust otherwise a paragraph 403(a), 403(b), or 457(b) package.

The cash Taxation Act and also the Income tax Regulations lay out minimal criteria to own an acknowledgment as appropriate plus the process that must be followed whenever issuing invoices. Budget 2024 recommends individuals amendments for the Taxation Operate to help you help clarify and modernize exactly how the new CRA brings functions and you will interacts advice per registered charities and other certified donees. A great qualifying company transfer to an employee collaborative could be entitled to the new 10-year money gains set-aside and also the 15-seasons different to your shareholder mortgage and you may desire work for laws and regulations launched in the Finances 2023.

The newest T&I places are insured to your a great “pass-through” base on the borrowers. The newest analogy lower than illustrates exactly how a wife and husband which have around three students you’ll qualify for up to 3,500,100000 in the FDIC visibility at the you to covered financial. This case assumes your fund take place in the qualified deposit things during the an insured financial and they will be the just account that the loved ones provides during the bank. The new FDIC will bring separate insurance rates to have an excellent depositor’s financing at the same covered financial, if the dumps are held in various possession categories. So you can be eligible for so it lengthened publicity, the requirements to possess insurance in the for each and every possession group should be met. If you were a resident of Ca for at least half a dozen months inside the 2024 and you may paid off lease to your possessions inside the Ca, that was the dominant home, you can even qualify for a cards that you can use so you can reduce your income tax.

As you may know from to play Bejeweled, and when a victory models to the game, the fresh treasures disappear. The fresh signs following the frequently finish the the fresh gap and possibly setting the newest combinations. Benefits to the seek an informed crypto gambling establishment bonuses are largely going to find them from the the brand new gambling enterprises than just old of them. Bringing boards, safer rooms, and a list of remedies, Gamtalk try a free of charge and private solution found in the the company the newest us and you may worldwide. Most of these are more quantities of defense and you will confidentiality the brand new finest casino web sites are still have regarding the provide.

They doesn’t matter your budget, you’ll find an online gambling enterprise web site to help you serve your financial demands. Sweepstakes websites and a real income gambling enterprises along side You.S. function lower minimum places. Usually, a bona-fide currency brands are 10 if not 20 lay gambling enterprises. If you buy a product or service otherwise register for an account due to a connection on the our site, we would receive payment. Using this web site, your accept the Affiliate Agreement and you can agree that the clicks, connections, and personal advice is generally collected, submitted, and/otherwise held from the all of us and social media and other third-team partners relative to our Online privacy policy.

Rates As low as

You can enjoy the same live video game, incentives, and you may payment alternatives while the on your computer. There is absolutely no elegance several months if the beneficiary out of a great POD account dies. Usually, insurance policies to the deposits will be shorter instantaneously. Regarding the unrealistic enjoy from a financial incapacity, the new FDIC acts quickly to safeguard insured deposits by the arranging a great sales so you can a healthy lender, or if you are paying depositors personally due to their deposit account on the covered limitation. A health Savings account (HSA) are an enthusiastic Irs accredited taxation-excused believe or custodial put that is based having a qualified HSA trustee, such as a keen FDIC-insured lender, to spend or reimburse a depositor definitely scientific expenditures. Because the Lisa have entitled about three eligible beneficiaries between Membership step 1 and you can 2, the woman limit insurance is 750,100 (250,100 x step three beneficiaries).